Tokens with low circulating supply (low float) and high fully diluted valuations (FDV) have taken their fair share of beatings - from thought leaders and in the charts. The narrative has shifted towards a higher float at TGE. This is partly inspired by the outperformance of memecoins which launch with 100% of supply circulating.

Of course, the market is oversimplifying it once again.

There are multiple reasons that make it difficult to derive generally applicable insights from memecoins:

High failure rate: Success stories of a few top memecoins often lead to misleading conclusions about key success factors (survivorship bias)

Limited generalizability: Memecoins operate under their own rules which don’t apply to utility-focused tokens that have additional requirements (e.g. teams need to raise funds to build a product)

Current outperformance leads to biases that skew analyses and drive short-term thinking (recency bias)

Memecoins have their own supply issues, such as unclear team/insider allocations

Despite these complexities, the shifting narrative warrants a deeper analysis, serving as a starting point to explore potential improvements in token allocations, emissions, and other areas of tokenomics.

The status quo playbook for such listings has been the following:

Raise from VCs at high FDV (our product might change the fabric of society after all)

Run airdrop campaign to boost numbers needed for CEX listing & provide free money to launchpool users

Launch on a CEX with <15% tokens circulating, hence low float/high FDV

Let the token do its thing

As a reaction, there have been calls for shorter/no vesting for VCs to increase float

In this piece, we’ll explain why shorter vestings are only scratching the surface and uncover the underlying challenges in tokenomics. At the end, we provide ideas for improvement.

Low Float/High FDV Lowkey Sucks fr fr, But Things are More Complex

Low Float/High FDV Bad

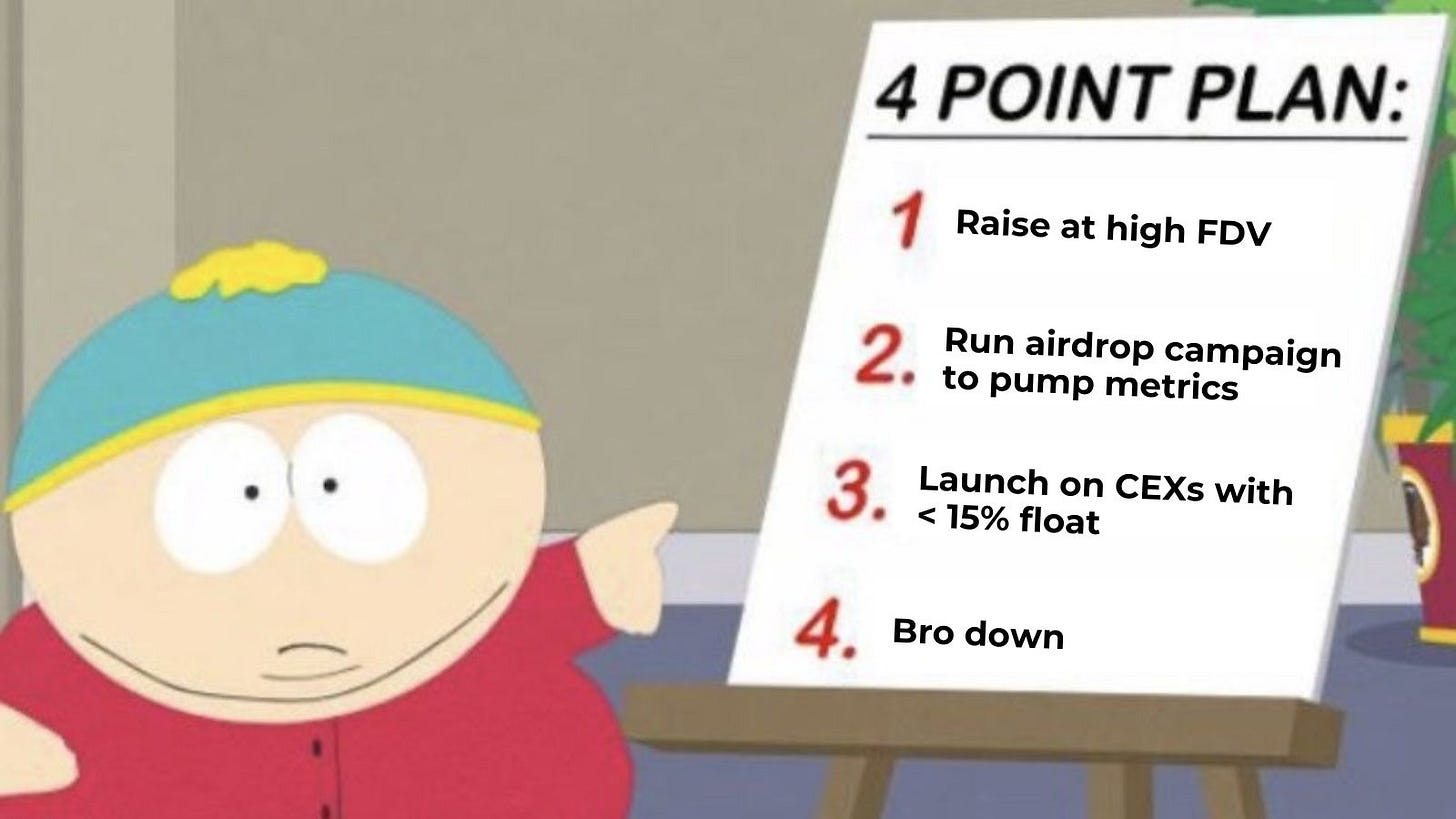

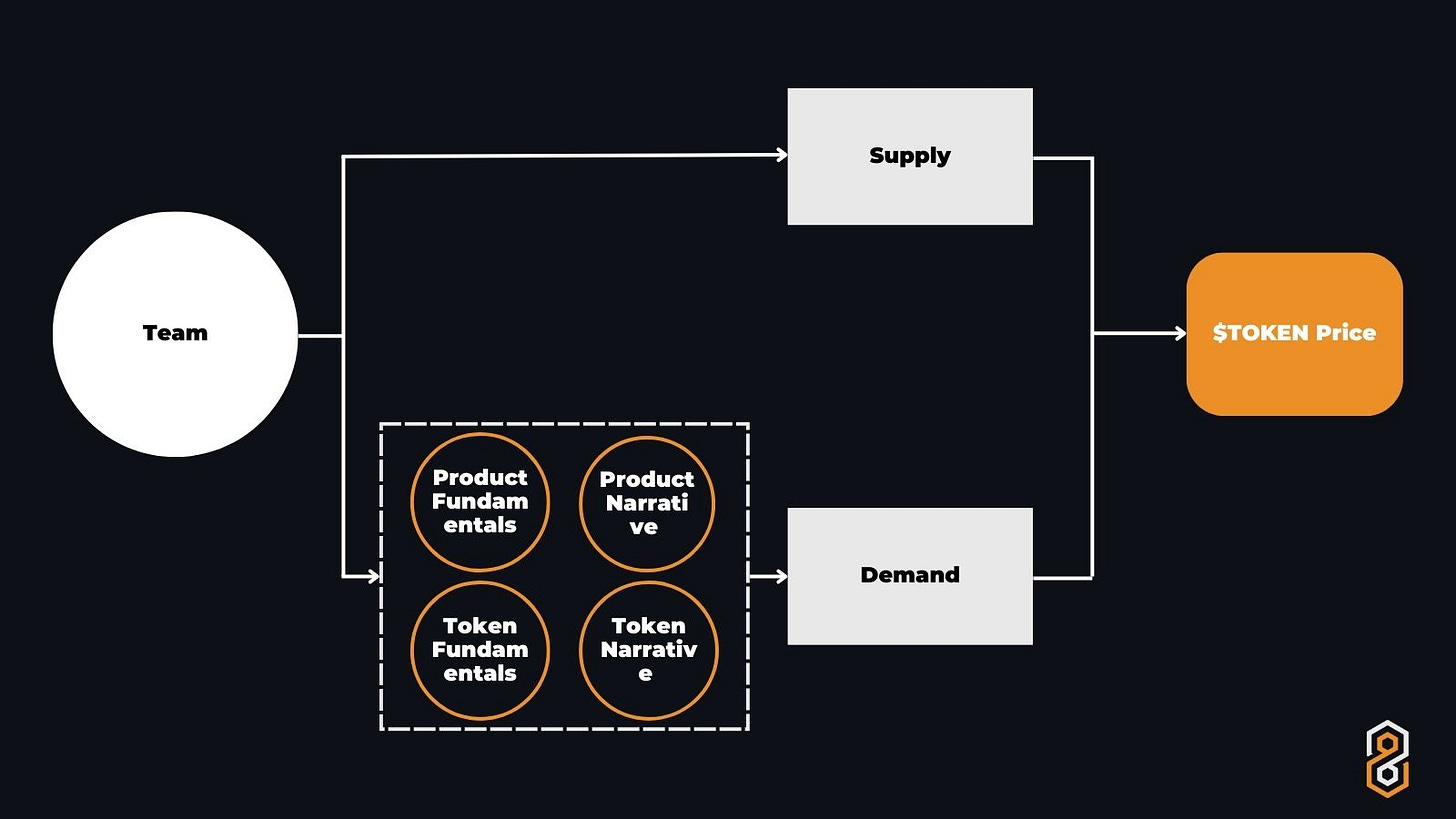

The issue with low float tokens is evident in many charts. Price acts as a market signal, resulting from supply and demand dynamics.

While supply can be managed directly, demand is market-driven. Still, teams can influence demand through product fundamentals, token design (most importantly value capture), opening up distribution channels (e.g. Tier 1 CEXs) where demand resides, and building a strong narrative for product and token (pumpamentals).

Issues occur however when there’s a strong mismatch between supply and demand where supply >> demand.

At TGE, a low supply often meets maximum demand, creating the common pattern of “high FDV on Day 1 into prolonged slow bleed”. Teams often aggressively market their TGE to maximize the initial FDV. Also, markets naturally pay attention to new tokens, driving demand for the TGE instinctively. Afterward, demand decreases while existing bagholders lose conviction (the product might actually not change the fabric of society), driving prices downwards. To that, add investor unlocks which constitute additional potential sell pressure, triggering preemptive dumping by market participants. Future unlocks loom over the token like Damocles’ sword.

Problems Are Like The Crypto Industry, There Are Always More Layers

Low float/high FDV has two, partly correlated components: Float and valuation. Let’s start with the latter.

Why do teams opt for high FDVs? The answer lies in step 1 of the playbook: Raising at a high FDV. Primary markets have become increasingly competitive (for top projects), driving up valuations. For teams, it makes sense to raise large rounds at high FDVs:

Higher valuations mean fewer tokens are going to investors (for the same fundraising amount)

Often, however, teams keep the allocation to investors constant (~15-20%), meaning they can raise larger amounts. This gives them runway throughout one or even multiple bear markets. More importantly, teams see it as a must to compete with others who also hold large war chests

It is estimated that approximately US$155B worth of tokens will be unlocked from 2024 to 2030 (source).

These ballooning valuations from primary markets can’t be sustained in the secondary market as the narrative might have already shifted to a new shiny thing and when reality sets in after the product launch, painting a more realistic picture of market potential.

By maximizing valuations in primary markets and at TGE, teams may negatively impact their long-term FDV by excluding a large percentage of market participants from price discovery and the related wealth effect. Today’s market demands a shift in mindset—teams must embrace a new route to thrive. Yet, many still favor what feels like the safer route: securing quick funding at high fully diluted valuations (FDVs) right from the start. A large fundraise provides essential resources for product development, marketing, and incentive programs—all of which can help support and increase token value.

The alternative is much more uncertain and raises tough questions. What’s the impact of a well-performing token on future FDV? How can we ensure that the value generated benefits committed, long-term holders rather than being quickly scooped up by snipers and opportunistic traders at launch? Does the narrative change towards more community-oriented tokenomics strengthen the effect?

Is “price up” the best marketing?

Now onto the low float part of the equation. What makes low float tokens perform as they do at the moment are not the bad evil VCs - they’re still locked at TGE and the months after. It’s the narrative of future potential sell pressure. Another part is airdrop farmers with a cost basis of zero (excluding fees paid).

The idea behind short or even no vesting for VCs is to match the high demand at TGE with the supply of VCs. This would mean a lower initial FDV that prices in all immediate sell pressure instead of having people try to forecast the future sell pressure. Afterward, there’s less (perceived) sell pressure to suppress the price.

On a macro level, this might shift the VC format from long-term venture bets to something resembling pre-market liquid funds. Crypto VCs already benefit from faster liquidity than Web2 VCs.

The key point here is that vesting for investor allocations can be just one of the implications of the bigger topic at hand - accessibility. People want to feel early to deals again. Experience price discovery in public markets. For some deals, that may even be the case at current FDVs, knowing that no one else got a better valuation. For other deals, that could mean reducing FDVs closer to the private markets round. This may show itself in shorter vesting for investors as converging valuations across primary and secondary markets change investment dynamics. VCs will want to take on less liquidity risk when valuation discrepancies close.

Disclaimer: Regulatory feasibility of shorter vesting periods for investors is not considered. Not legal advice.

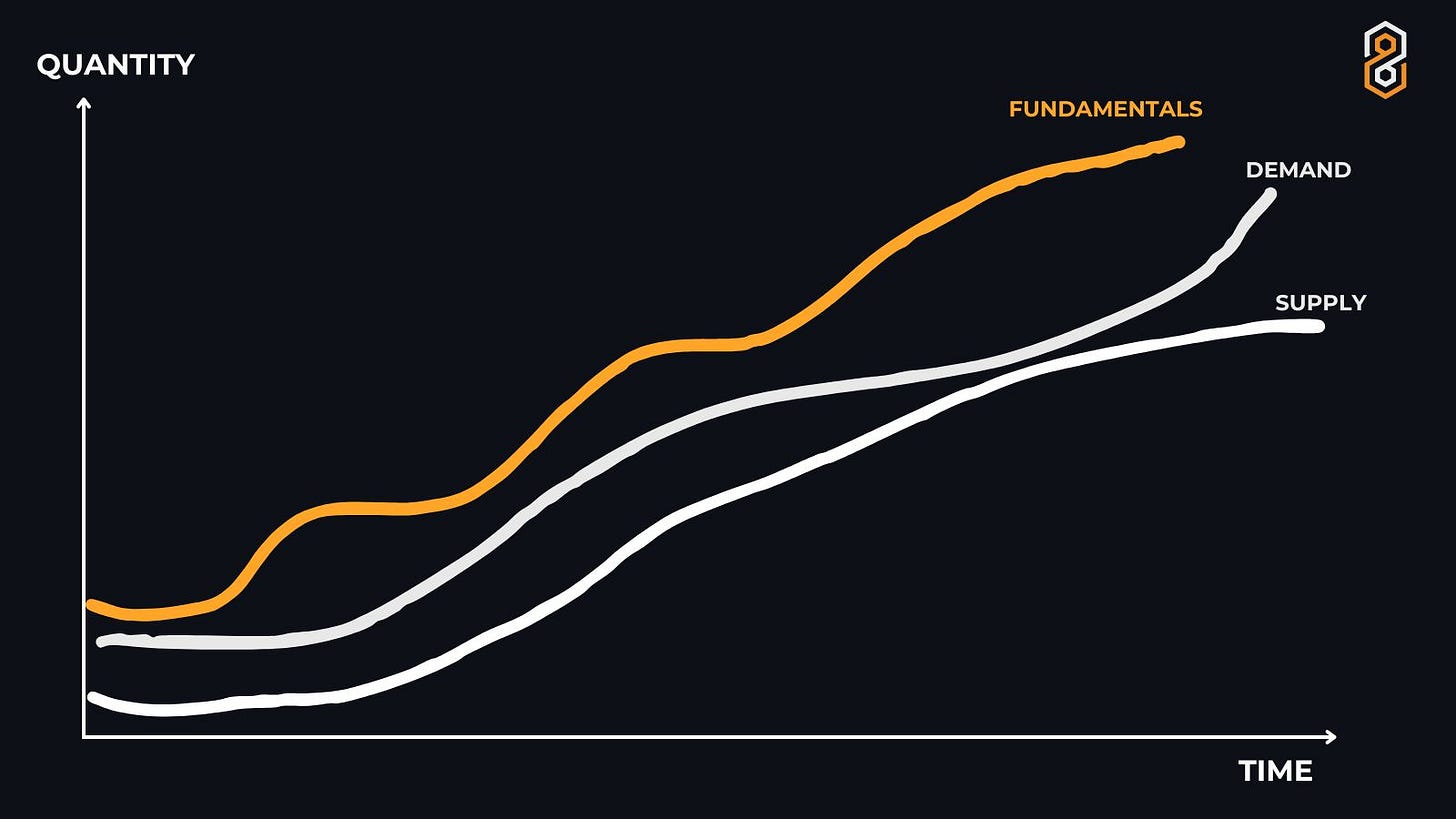

Returning to the core principle: Price reflects the balance of supply and demand. Teams must actively manage both over time. Investor cliffs and vesting schedules are designed with this in mind, giving products time to build their competitive edge—whether through network effects like sticky liquidity or complementary projects that boost the ecosystem. The goal is to balance supply and demand over time. If done well, this can drive a token’s intrinsic value.

But, there are more factors that create demand for a token, as described above:

Product fundamentals (e.g. tech, user adoption)

Token fundamentals (value capture)

Product narrative (e.g. “intent-based AI agentic protocol for DePIN management”)

Token narrative (number goes up)

We categorize investor vesting into the “token narrative” bucket. It’s currently being highlighted by the market and therefore can exhibit a positive effect on demand. However, it also directly impacts token supply which is part of token fundamentals

Positive effect on float (and therefore inflation rate)

Negative effect on direct sell pressure

Additionally, numerous other factors influence demand, as we’ve discussed. Every team should take a custom approach to their tokenomics, assessing what will work best for their unique situation. Investor vestings are just one small piece of a bigger puzzle.

Considering the supply side, things are also more complex. A certain degree of float is needed for sure, but it’s also about how non-circulating supply hits the market, the timeline (inflation rate) and who it’s being distributed to, and how it is matched with demand.

Holistic token economy based on product value flows, stakeholder needs (e.g. teams need funding to finance multi-year product development), and business strategy >>>> copy-paste tokenomics based on current sentiment on X.

Learnings For Tokenomics

Given our analysis, we expect the following trends in token design to accelerate.

Private market valuations will come down to healthier levels

As competitive primary markets have driven valuations up, these have become harder to sustain in secondary markets. Two trends are creating downward pressure on fundraise valuations

VCs transitioning into liquid funds which opens up new opportunities for them. Instead of competing solely on new fundraises, investors can also allocate their capital into secondary markets such as established teams with a proven track record or memecoins. This reduces demand in primary markets. New tokens need to provide more realistic FDVs as they’re now directly competing with all other existing tokens.

Sentiment change in secondary markets which led to new shiny launches underperforming (high) expectations on a low-to medium timeframe

Having said that, a full-blown high-euphoria bull market may still see high-FDV token raises and launches for the next society-changing paradigms which are onboarding the next trillion users.

We also expect teams to experiment more with shorter vesting terms, including some where it makes sense and some where it doesn’t.

Accessibility for retail

In every bull market so far, launchpads have performed well. While the quality of projects can differ, they provide everyday users with better access to new launches.

We expect the following changes to the standard launchpad formula:

Rather than gating access via a launchpad token, users will “earn” access via other means, for example their onchain activity, social activity, or other forms of value add. For instance, Legion is building a platform for that.

Airdrops will become part of these launchpads. Instead of giving free tokens to users, some teams will run point campaigns and similar events to provide access to the public round, supported by additional data. This distributes supply more effectively to high-value holders. If done correctly, this can result in lower sell pressure.

Launchpads are verticalizing. Launchpads like pump.fun (memecoins) or virtuals.io (AI agents) target a specific niche, providing fixed templates for launches (e.g. bonding curve graduating into LP) and product tools (e.g. cross-agent communication frameworks)

While accessibility creates competition, we believe it will crystallize less in investors competing in how high of a valuation they are willing to pay (short-term FDV optimization) and more in their value-add. For example, how diamond-handed they are. This better aligns with long-term valuation optimization. User sentiment will be a key determinant for which way will be chosen here.

Of course, there will still be teams looking to extract as much value as possible by maximizing valuations during fundraising without much consideration of long-term effects. That’s similar to the current primary markets or ICOs. However, retail users will be able to access good deals through these new forms of launchpads.

Improvements in supply-demand balancing

While the previous trend helps the supply side by distributing tokens to better-aligned holders, further measures can be taken by teams. This may include:

Milestone-based vesting to better match supply release with demand. The challenge here is to pick metrics that are a) correlated with actual token demand b) hard to game

Gamified vesting that provides incentives to hold rather than hard cliff and vesting

Delay TGEs further to when strong network effects, and therefore demand, has been established.

On the demand side, teams can also take measures to influence markets. Taking a LiveOps view on tokens helps teams create a timeline which supports price over time. Rather than releasing all news at TGE, spread them out. Launch on DEXs first, CEXs later.

In the end, what matters long-term for demand is a product with true product-market-fit that creates revenue and a token that captures part of that value. The possible policy change in the US creates a positive environment for this to happen.